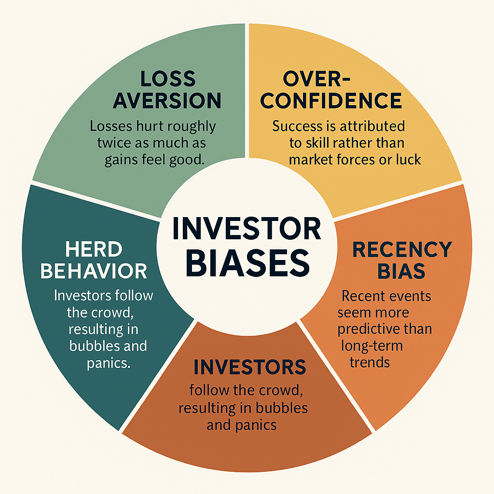

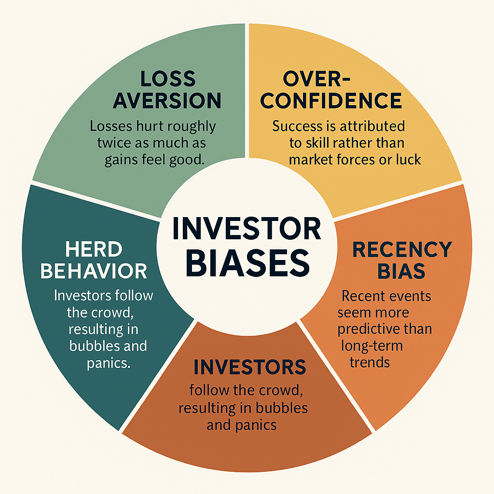

Financial markets reward discipline, but investors rarely behave in perfectly rational ways. The study of behavioral finance has shown that emotions and biases shape decisions in ways that can undermine long-term outcomes. Understanding these tendencies is not an academic exercise. It is a practical tool for avoiding mistakes that repeat across every market cycle.

Common Behavioral Biases That Distort Decisions

Loss aversion

Research shows that losses feel roughly twice as painful as comparable gains feel rewarding. This imbalance often pushes investors to sell too quickly at a loss or hold onto losing positions in hope of a rebound.

Overconfidence

Periods of strong returns can lead investors to believe their success reflects skill rather than favorable conditions. Overconfidence encourages concentrated bets and unnecessary trading.

Herd behavior

The urge to follow the crowd leads investors into bubbles and panics. Herding creates the sense of safety in numbers, but often results in buying at peaks or selling at lows.

Recency bias

The human brain places undue weight on the most recent experience. After rallies, investors expect them to continue indefinitely. After crashes, they assume recovery is unlikely.

Historical Lessons in Behavior

The dot-com bubble of 1999–2000 illustrated how herd mentality and overconfidence can push valuations far beyond fundamentals. The housing crisis of 2008 showed how recency bias convinced many that real estate prices could never decline nationwide. More recently, the sharp swings of 2020 highlighted both panic selling in March and euphoric buying later that year. In each instance, emotions overtook discipline, and the consequences were costly.

The Impact of Emotional Investing

Emotional decision-making typically leads to buying high and selling low, missing recoveries, or abandoning diversification altogether. Investors who deviate from long-term plans based on fear or excitement may find their financial outcomes significantly weaker than those who simply remained invested.

Strategies to Reduce Behavioral Mistakes

- Establish a written investment policy: Documenting risk tolerance, asset allocation, and rebalancing rules provides a roadmap for staying on course.

- Automate contributions and rebalancing: Removing decision points reduces the chance of emotional interference.

- Revisit market history: Recognizing that downturns and recoveries are recurring features provides perspective during turbulence.

- Seek external perspective: Advisors and committees add accountability, helping investors resist the urge to act on headlines.

- Practice emotional awareness: Naming the emotions felt during market swings — fear, greed, anxiety —helps lessen their influence.

Why Mastery of Behavior Is the True Edge

No strategy can remove volatility from markets. What investors can control is their response. By understanding the psychology of loss aversion, overconfidence, herding, and recency bias, individuals give themselves an advantage that compounds over decades. Mastery of behavior is not about eliminating emotion but about putting boundaries around it. That discipline is often the decisive factor in turning investment potential into lasting results.