Investor Confidence vs. Market Reality: What 2025 Data Reveals About Retail Behavior

Key takeaways

- Retail investors in 2025 were deeply bearish during the spring sell-off, then turned aggressively bullish by fall, often reacting emotionally rather than strategically.

- Even as profits and inflation data improved, investors panicked early — and later grew overly confident despite weakening consumer and labor trends.

- Investors who rebalanced during fear and trimmed risk during exuberance benefited most. Staying anchored to fundamentals, not headlines, was the year’s real advantage.

If 2025 taught investors anything, it’s that confidence and fundamentals don’t always move in sync. While the economy steadied and inflation cooled, investor emotions went through a full market cycle — fear, disbelief, acceptance, and finally, euphoria — all within a single year.

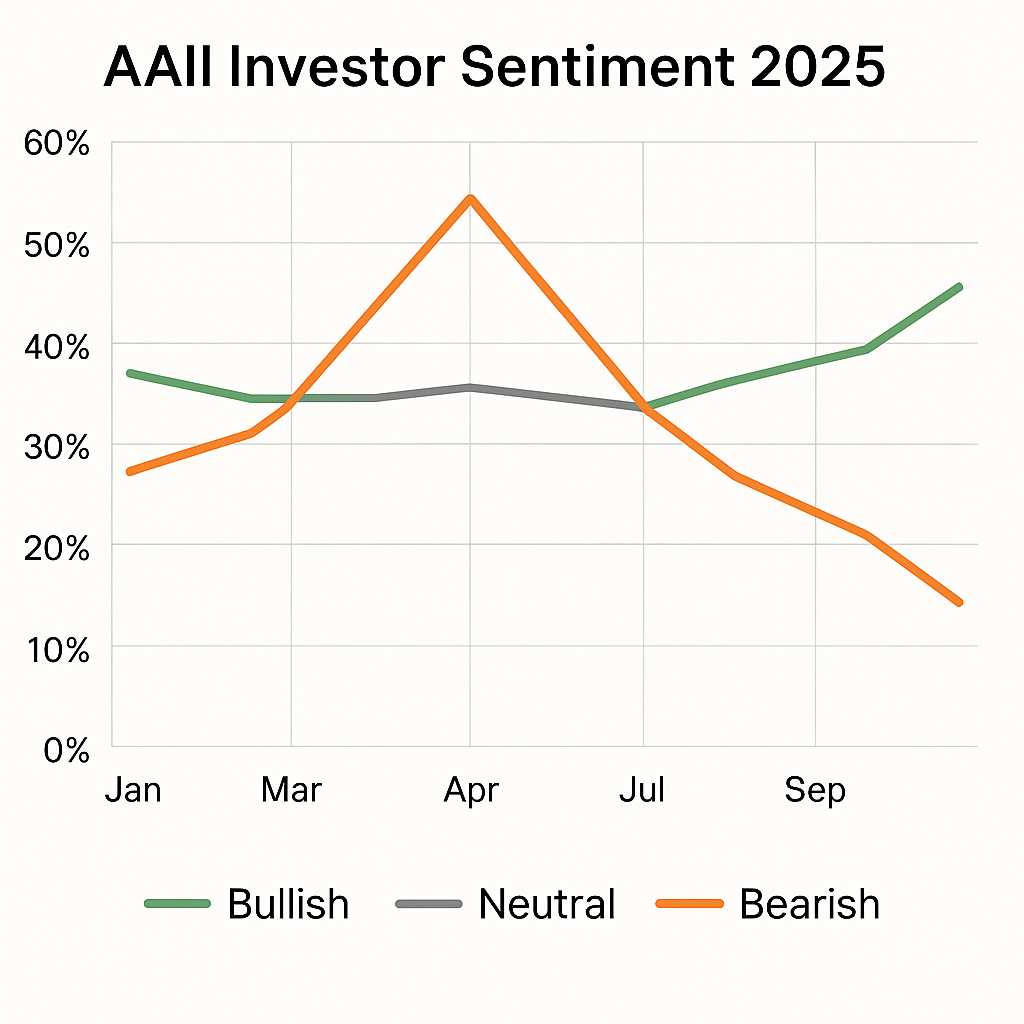

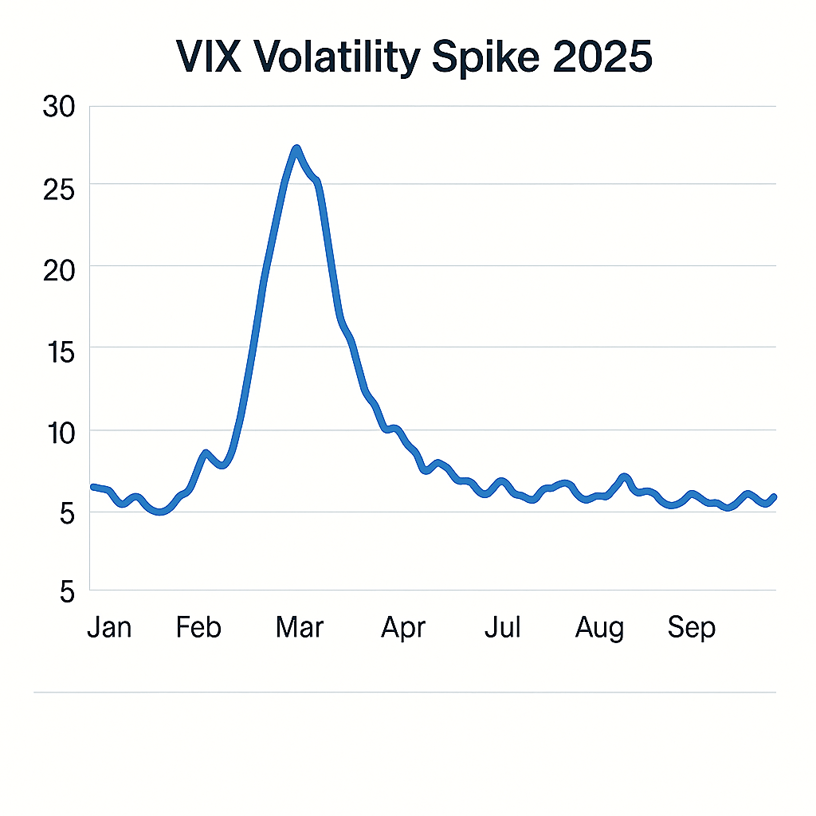

Surveys from the American Association of Individual Investors (AAII) captured those mood swings vividly. In March, bullish sentiment plunged below 20%, one of the lowest readings since 2009. Six months later, it was back above 40% as markets rallied and fears faded. Meanwhile, the CBOE Volatility Index (VIX) — Wall Street’s “fear gauge” — spiked above 60 in April, a level historically reserved for crises like 2008 or early 2020. By mid-summer, it had collapsed to near-record lows.

Source: American Association of Individual Investors, Sentiment Survey

The emotional whiplash was unmistakable. Investors were terrified when prices were lowest — and fearless when valuations peaked. If that sounds like a recipe for disaster and lost opportunity, you ain’t wrong.

From Panic to Profit: How Retail Investors Drove the Rebound

One of the more surprising stories of 2025 was who kept buying when the market cracked.

During the spring selloff, while institutional investors cut exposure, retail investors stepped in. ETF data showed that billions flowed into broad-market index funds in March and April — the very moment the S&P 500 was down over double digits into early April.

That contrarian behavior paid off. From its April low to October, the S&P 500 surged, delivering one of the strongest six-month recoveries in decades.

But confidence didn’t stay disciplined for long. By summer, retail investors had shifted from cautious optimism to aggressive risk-taking. Charles Schwab’s Trading Activity Index (STAX) recorded rising engagement and record inflows.

The same investors who bought the dip in April were now chasing returns by September. Options trading exploded, meme-stock forums buzzed back to life, and speculative growth funds outperformed blue-chip benchmarks.

Behaviorally, it was a complete pendulum swing — from fear-based selling to FOMO-fueled buying.

Source: CBOE Volatility Index

The Great Divergence: Confidence and Reality Drift Apart

Early in 2025, pessimism far exceeded what the data justified. Corporate profits were still strong and inflation was cooling toward 3%. Yet investor sentiment plunged to recession-like levels.

By year-end, that imbalance flipped. Markets roared back, but optimism overshot fundamentals. Call-option volume spiked, retail cash levels fell to multi-year lows, and a handful of AI and semiconductor stocks drove most of the index’s gains.

Meanwhile, consumer confidence slipped — falling to its lowest point since April — and job market data began to soften. In short: Wall Street’s optimism surged while Main Street’s confidence waned.

That divergence between emotional momentum and economic reality is precisely what makes investor psychology so powerful — and so dangerous — for long-term portfolios.

What Fueled the Emotional Cycle

Investor sentiment in 2025 followed a clear sequence shaped by three macro narratives:

- Fear of Crisis (Q1–Q2)

Early in the year, two shocks shook confidence: a brief military flare-up in the Middle East and renewed U.S.–China/global tariff threats. Combined with a hawkish Federal Reserve, the headlines spurred fears of recession. The S&P 500 fell sharply, and the VIX hit panic levels. - Relief and Recovery (Q2–Q3)

When tariffs were delayed and the Federal Reserve signaled patience, sentiment flipped almost overnight. Inflation data surprised to the downside, and investors began pricing in rate cuts. “Bad news became good news,” as soft economic data fueled hopes of easier policy. - Euphoria and Narrative Investing (Q3–Q4)

By autumn, the AI-driven tech boom had turned into full-blown optimism. Mega-cap names like NVIDIA, Broadcom, and Microsoft led the charge — and retail traders followed. The story of “unstoppable innovation” overshadowed concerns about valuation, consumer strain, or narrow market breadth.

Each stage reflected a familiar human cycle: fear, relief, greed. And as behavioral finance teaches, investors often overreact to both the downside and the upside.

Behavioral Biases Behind the 2025 Rollercoaster

1. Recency Bias: The Shadow of Yesterday’s Pain

After the volatility of 2022–2023, investors were primed for bad news. The fear of another crash made every negative headline feel like the start of something bigger. That bias caused many to underestimate the market’s resilience — and sell too early.

2. FOMO: The Fear of Missing Out

Once markets recovered, regret replaced fear. Watching neighbors or social media peers post about massive gains triggered a stampede back into equities. Investors began to buy not because of valuation, but because others were making money.

3. Overconfidence and Confirmation Bias

By late 2025, overconfidence took hold. Traders assumed that because tech stocks had been right all year, they’d stay right forever. They sought data that confirmed that belief — and ignored signs of cooling momentum or stretched multiples.

4. Herding and Social Proof

The rise of online investor communities amplified crowd behavior. Seeing thousands of others buying the same handful of names created a self-reinforcing loop. Volume bred conviction — even when logic lagged.

These aren’t flaws unique to retail investors. They’re deeply human tendencies.

The difference between success and regret often lies in recognizing — and managing — those instincts before they control decisions.

Why Fundamentals Still Matter

The irony of 2025’s emotional swings is that the fundamentals never fully broke. Corporate earnings remained solid, consumer spending softened but persisted, and inflation continued to cool. The Federal Reserve managed a rare balancing act — maintaining higher rates without triggering a recession.

And yet, confidence collapsed as if the sky were falling — then later surged as if it could never rain again. That gap between perception and reality underscores a timeless truth: markets are rational in the long run, but emotional in the short term.

For long-term investors, that disconnect is opportunity. Periods of fear often present better valuations. Periods of euphoria often present chances to rebalance and protect gains.

Those who recognized April’s panic as a buying opportunity — or October’s exuberance as a reason for caution — weren’t lucky. They were disciplined.

Lessons for High-Net-Worth Investors

1. Use Sentiment as a Contrarian Indicator

When surveys show extreme fear, history suggests better entry points. When optimism hits euphoric levels, risk is often highest. Monitoring tools like the AAII Sentiment Survey or the VIX can help identify when emotions — not fundamentals — are driving price.

2. Stay Strategic, Not Reactive

The investors who thrived in 2025 weren’t those who guessed correctly — they were those who stuck to a plan. Rebalancing during drawdowns, harvesting gains after rallies, and resisting panic proved far more effective than timing swings.

3. Diversify Across Storylines

AI, energy, and infrastructure all had their moments in 2025. But concentration in a single “theme” can amplify emotional risk. Balanced portfolios reduce the urge to chase the latest trend.

4. Partner With Perspective

Working with a fiduciary advisor provides the emotional distance most individuals can’t maintain alone. A disciplined advisor acts as a buffer between market noise and long-term goals — turning volatility into opportunity instead of stress.

Looking Ahead: 2026 and Beyond

As we move into an election year, the same emotional patterns are likely to return. Volatility tends to rise around political uncertainty. News cycles will alternate between optimism and panic. And investors will once again face a choice: react emotionally, or respond strategically.

The year of 2025 offered a live demonstration of both paths. Those who sold in fear missed one of the strongest rebounds in recent history. Those who chased late may find that expectations — like valuations — need to reset.

But for those who stayed focused on fundamentals, maintained balance, and tuned out the noise, 2025 served as confirmation that discipline still outperforms drama.